Examples Of Itemized Deductions 2020 . types of itemized deductions. common itemized deductions include medical expenses, charitable contributions and mortgage interest costs. Itemized deductions include a range of expenses that are only deductible when you choose to itemize. itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your total. See how to fill it out, how to itemize tax deductions. schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. For example, the deduction for unreimbursed. • medical and dental expenses. itemized deductions include amounts paid for qualified: 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions.

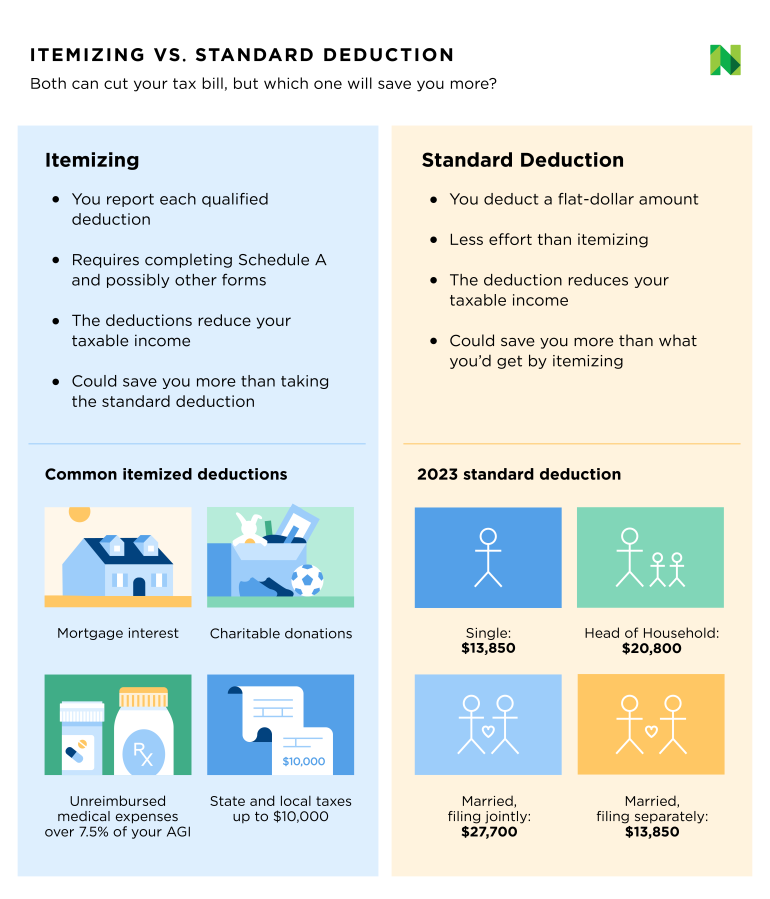

from www.nerdwallet.com

schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. types of itemized deductions. For example, the deduction for unreimbursed. Itemized deductions include a range of expenses that are only deductible when you choose to itemize. itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your total. • medical and dental expenses. itemized deductions include amounts paid for qualified: common itemized deductions include medical expenses, charitable contributions and mortgage interest costs. See how to fill it out, how to itemize tax deductions.

What Are Itemized Deductions? Definition, How to Claim NerdWallet

Examples Of Itemized Deductions 2020 • medical and dental expenses. See how to fill it out, how to itemize tax deductions. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. Itemized deductions include a range of expenses that are only deductible when you choose to itemize. 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. common itemized deductions include medical expenses, charitable contributions and mortgage interest costs. schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). types of itemized deductions. For example, the deduction for unreimbursed. itemized deductions include amounts paid for qualified: itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your total. • medical and dental expenses.

From www.youtube.com

Itemized Deduction Schedule A Overview 502 Tax 2020 YouTube Examples Of Itemized Deductions 2020 itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your total. 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. See how to fill it out, how to itemize tax deductions. For example, the deduction for unreimbursed. itemized. Examples Of Itemized Deductions 2020.

From www.youtube.com

Itemized Deductions Form 1040 Schedule A YouTube Examples Of Itemized Deductions 2020 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. See how to fill it out, how to itemize tax deductions. • medical and dental expenses. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. common itemized deductions include medical expenses, charitable contributions. Examples Of Itemized Deductions 2020.

From www.danielahart.com

Schedule A Itemized Deductions Daniel Ahart Tax Service® Examples Of Itemized Deductions 2020 See how to fill it out, how to itemize tax deductions. 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. Itemized deductions include a range of expenses that are only deductible when you choose to itemize. schedule a is an irs form used to claim itemized deductions on a tax. Examples Of Itemized Deductions 2020.

From dremelmicro.com

Printable The Landlord's Itemized List Of Common Tenant Deposit Examples Of Itemized Deductions 2020 schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). • medical and dental expenses. Itemized deductions include a range of expenses that are only deductible when you choose to itemize. itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower. Examples Of Itemized Deductions 2020.

From www.uslegalforms.com

Itemized Security Deposit Deduction Letter 20202021 Fill and Sign Examples Of Itemized Deductions 2020 • medical and dental expenses. itemized deductions include amounts paid for qualified: common itemized deductions include medical expenses, charitable contributions and mortgage interest costs. schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). For example, the deduction for unreimbursed. types of itemized deductions. Itemized deductions include a range. Examples Of Itemized Deductions 2020.

From old.sermitsiaq.ag

Printable Itemized Deductions Worksheet Examples Of Itemized Deductions 2020 • medical and dental expenses. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. common itemized deductions include medical expenses, charitable contributions and mortgage interest costs. For example, the deduction for unreimbursed. See how to fill it out, how to itemize tax deductions. Itemized deductions include a range of expenses that. Examples Of Itemized Deductions 2020.

From www.kitces.com

The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA Examples Of Itemized Deductions 2020 types of itemized deductions. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. common itemized deductions include medical expenses, charitable contributions and mortgage interest costs. schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). For example, the deduction for unreimbursed. . Examples Of Itemized Deductions 2020.

From www.templateroller.com

Form PITNSA Schedule A Download Fillable PDF or Fill Online Itemized Examples Of Itemized Deductions 2020 schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. See how to fill it out, how to itemize tax deductions. itemized deductions include amounts paid for qualified: For example, the deduction for unreimbursed.. Examples Of Itemized Deductions 2020.

From taxfoundation.org

The Most Popular Itemized Deductions Examples Of Itemized Deductions 2020 Itemized deductions include a range of expenses that are only deductible when you choose to itemize. • medical and dental expenses. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your. Examples Of Itemized Deductions 2020.

From bench.co

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting Examples Of Itemized Deductions 2020 itemized deductions include amounts paid for qualified: schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized. Examples Of Itemized Deductions 2020.

From www.slideserve.com

PPT Itemized Deductions PowerPoint Presentation ID3396847 Examples Of Itemized Deductions 2020 itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your total. See how to fill it out, how to itemize tax deductions. • medical and dental expenses. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. common itemized deductions. Examples Of Itemized Deductions 2020.

From www.freshbooks.com

Examples of Itemized Deductions Examples Of Itemized Deductions 2020 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. types of itemized deductions. • medical and dental expenses. schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). See how to fill it out, how to itemize tax deductions. itemized deductions. Examples Of Itemized Deductions 2020.

From www.slideserve.com

PPT Standard Deduction & Itemized Deductions PowerPoint Presentation Examples Of Itemized Deductions 2020 types of itemized deductions. For example, the deduction for unreimbursed. 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. itemized deductions include amounts paid for qualified: Itemized deductions include a range of. Examples Of Itemized Deductions 2020.

From www.youtube.com

Schedule A Explained IRS Form 1040 Itemized Deductions YouTube Examples Of Itemized Deductions 2020 Itemized deductions include a range of expenses that are only deductible when you choose to itemize. 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. types of itemized deductions. • medical and dental. Examples Of Itemized Deductions 2020.

From www.vitaresources.net

Itemize deductions Examples Of Itemized Deductions 2020 • medical and dental expenses. For example, the deduction for unreimbursed. 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. itemized deductions include amounts paid for qualified: 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. See how to fill it out,. Examples Of Itemized Deductions 2020.

From standard-deduction.com

1040 Standard Deduction 2020 Standard Deduction 2021 Examples Of Itemized Deductions 2020 schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). types of itemized deductions. itemized deductions include amounts paid for qualified: Itemized deductions include a range of expenses that are only deductible when you choose to itemize. • medical and dental expenses. See how to fill it out, how to. Examples Of Itemized Deductions 2020.

From www.youtube.com

Itemized Deductions Casualty & Theft Losses 575 Tax 2020 YouTube Examples Of Itemized Deductions 2020 types of itemized deductions. common itemized deductions include medical expenses, charitable contributions and mortgage interest costs. itemized deductions include amounts paid for qualified: For example, the deduction for unreimbursed. itemized deductions are expenses on certain deductible products, services and contributions that you can report to the irs to lower your total. 2020 instructions for schedule. Examples Of Itemized Deductions 2020.

From www.printabletemplate.us

Printable Itemized Deductions Worksheet Examples Of Itemized Deductions 2020 For example, the deduction for unreimbursed. types of itemized deductions. 2020 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. 2020 itemized deductions the tax cuts and jobs act got rid of quite a few itemized deductions. schedule a is an irs form used to claim itemized deductions on a. Examples Of Itemized Deductions 2020.